First, here’s what this book is not: It’s not your parents’ money management and investing book, although as a parent I wish I had done in my twenties what Ramit Sethi tells the twenty-somethings they should be doing right now.

First, here’s what this book is not: It’s not your parents’ money management and investing book, although as a parent I wish I had done in my twenties what Ramit Sethi tells the twenty-somethings they should be doing right now.

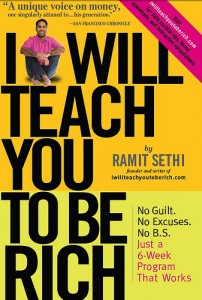

Ramit starts with the premise that most people are so overwhelmed by the sheer amount of financial information available that they just shut down and do nothing. So Ramit tells you exactly what to do with your money and why. 20 and 30 somethings are the intended audience for this book. And for them the book is delightfully irreverent and saucy in its language.

Ramit also tells the truth about brown-bagging your lunch and curbing your latte habit; and the truth is that these actions on their own are virtually pointless. Instead, you should go after

the big wins, like getting the lowest interest rate and the best price on your next car because you have impeccable credit and negotiated “like an Indian” (negotiation scripts included).

Ramit maps out exactly how to get from where you are now to where you want to be financially, including how to create a personal money management system that practically manages itself. Ramit’s system starts with a no-fee

checking account and an online high-interest savings account. (He even tells you which online bank he uses.) He then walks you through setting up automatic bill payments and regularly scheduled transfers to your investment accounts. Throughout, he includes easy-to-understand charts, as well as short pieces by other personal finance bloggers.

There are no new financial revelations in this book. If you already have a personal finance library you can pass on this book. If you don’t already have one and are looking for a place to start, this book is a great way to go. I Will Teach You To Be Rich is not for people who have created a measure of wealth and are looking to increase it. For that you will have to look elsewhere.